Should I save in pounds?

Why currency hedging may not be the best way to save for education

A few days ago, my college friends from the UK were discussing amongst ourselves how if we had saved our college tuition in pounds instead of rupees, we would have saved over 15%, equating to tens of thousands.

This practice is known as currency hedging, and on paper, it almost seems like a no-brainer. Interestingly, we learned that all that glitters may not be gold.

Here, we explore the nuances to currency hedging.

Studying in the UK

The UK is a popular destination for students who want to pursue higher education. Close cultural links with India, simple(r) immigration policies, and ease of access all make it ideal. However, the sliding value of the Indian rupee has made studying in the UK a far more expensive endeavor in recent years. But what if you had saved in 2020, for studies in 2022-2025, two to five years in advance.

A top-tier university in London costs roughly between £20,000 to £27,000, depending on the course. Combined with living expenses, the bill rises to close to at least £100,000 for a three-year undergraduate degree. Today, this translates to ₹1.05 crores at today’s value. But five years ago, this figure was 13.58% lower, at ₹93.44 lakhs.

The solution seems simple right? Save in pounds. But there are a few key points. First of all, every currency has its vulnerabilities, influenced by foreign and domestic policy. The pound saw massive falls in early 2020 (Russia’s Ukraine invasion) and mid-2022 (Liz Truss’ disastrous economic policies). While the currency has since recovered steadily for a myriad of factors, such shocks can hardly be protected against.

This model also doesn’t account for two of our favorite topics: opportunity cost and taking risks.

Opportunity cost of the hedge

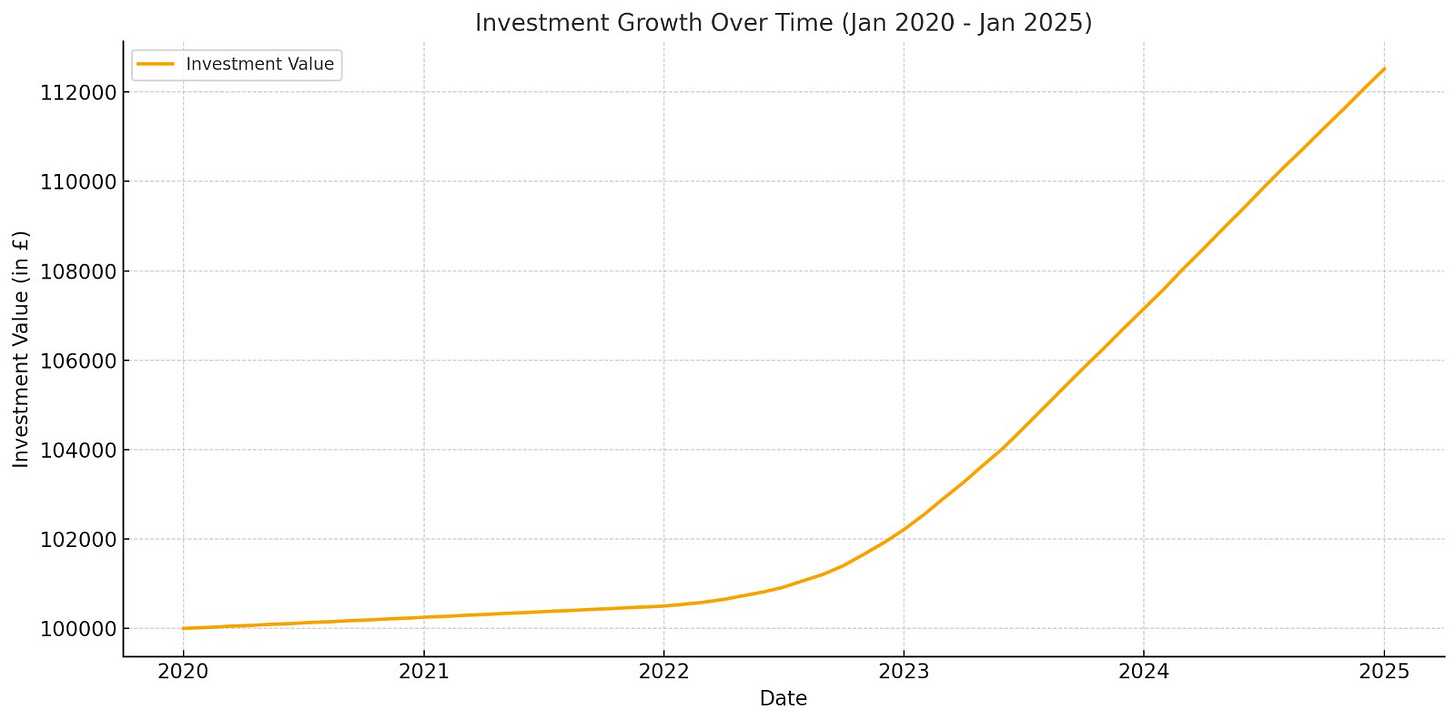

Education requires dedicating saving, which means no high-risk assets and stable savings accounts or overnight mutual funds. In January 2020, the Bank of England's interest rate stood at 0.1%, spiking to 5.25% to combat inflation in 2023, and now stands at 4.75%.

If £100,000 is held in a savings account, assuming a bank rate, five years later, you would have £113,073. (Note that this figure is almost exactly the same as the difference in GBP vs INR over five years). That’s an increase of 13% over the five years.

Now let’s assume you saved the same amount in India, taking advantage of the much higher interest rates. Given the impact of COVID and inflation, rates in India fluctuated too, falling to 4% and all the way up to 6.5% at their peak and current rate.

Over our five-year period, the initial ₹92.44 lakhs would increase to ₹1.22 crores, or £115,000 after 5 years, an increase of 32.91%. Notably, this increase covers both the currency depreciation (13.6%) and the interest in GBP (13%) and adds another 6.9% on top. This final amount is the opportunity cost the hedge.

In an ideal free market, currency appreciation in one country is covered by higher interests in the other.

Risk

Currency can quickly move against you as well. As we saw in our pound vs rupee analysis, sharp decreases can suddenly leave you exposed, and with the entire corpus already in one currency, there are few options other than waiting. This means holding in INR is the better solution over a long period, assuming a similar high-yield savings account.

It should be noted that education savings should never be conflated with investments. We’ve gone into great detail about how diversification of assets is key to a burgeoning portfolio and long-term benefits. Moreover, given the instability of even major currencies that we’ve seen above, having a nest egg abroad is vital to planning.

An efficient market will be able to balance the risk of currency arbitrage with higher interest rates, making risk unnecessary. While markets can face plenty of bubbles and shock changes, the rupee follows this hypothesis today.

Learn more about Paasa and our investment thesis here.