I think most people don’t think about risk deeply enough. They see it as something to avoid or something to endure, but rarely as something they can quantify and manage to drive better outcomes. But risk isn’t inherently good or bad. It’s a tool - and when you understand how to use it, you can create outcomes most people never imagine.

What’s counter-intuitive is you don’t always have to take on more risk to achieve better returns. This isn’t just a theory. It’s a principle grounded in math, strategy, and a willingness to look at the bigger picture.

Before we get into how to do this financially, let’s break down risk.

What is Risk?

At its core, risk is the possibility of loss. In finance, it’s the chance your investments won’t perform as expected. But risk is interesting: it’s also the mechanism that makes growth possible. Without it, there’s no progress - or there is risk-free progress, which generally is the slowest form of progress.

In a portfolio, there are two main types of risk to understand: systematic risk and unsystematic risk.

Systematic Risk is the kind of risk you can’t avoid. It’s the big - macro - stuff: inflation, interest rates, geopolitical uncertainty. Think of it as the weather: you can’t control it, but you can prepare for it.

Unsystematic Risk, on the other hand, is specific to individual companies or sectors - more micro. Imagine putting all your money into one company. If it fails, your portfolio fails.

Measuring Risk

In finance, risk is something you can measure. Every asset has a level of risk, often expressed as standard deviation, which tells you how volatile assets are, or, how much its returns might fluctuate.

Stocks: Relatively high risk, with a standard deviation of ~15% annually.

Bonds: More stable, around 3-5%.

Cryptocurrencies: Wildly unpredictable, often exceeding 80%.

But these numbers only tell part of the story. What matters most is how the assets in your portfolio interact with each other. This is where diversification comes into play.

Diversification: Smarter Risk, Better Outcomes

Diversification is about spreading your investments - thoughtfully. It’s the difference between throwing darts and playing chess.

Start with unsystematic risk. This one’s easy. Spread your investments across different industries and companies, and this kind of risk largely disappears. You can do this with a Broad Market ETF or Mutual Fund.

Systematic risk? That’s trickier. Even so, diversification can help here too. By spreading your investments across:

Asset Classes: Stocks, bonds, real estate, and commodities. These react differently to changes in the economy.

Currencies: Holding assets in multiple currencies hedges against the risk of one losing value.

Geographies: Investing globally reduces dependence on any single region’s economy.

I imagine diversification as building a network of safety nets. If one fails, another is there to catch you. It doesn’t eliminate risk, but it transforms it into something more manageable - and even more valuable.

The Math Behind Diversification

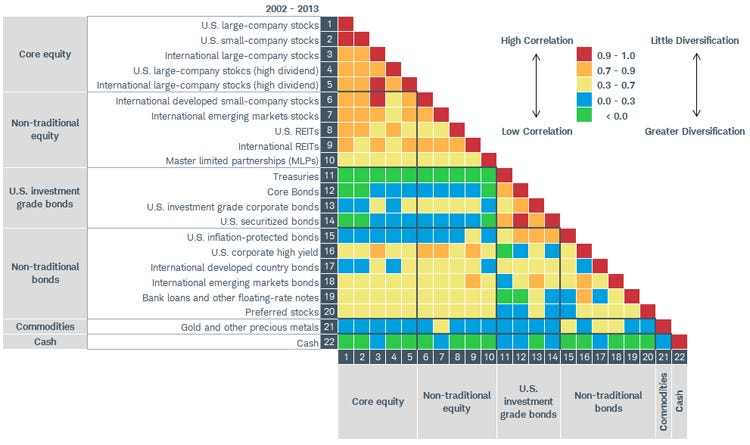

This is where diversification becomes more than common sense. Statistics prove it. The key is covariance, which measures how two assets move relative to each other.

If one asset zigs while another asset zags, their covariance is low. A portfolio built with low-covariance assets is less volatile, which means it’s less likely to experience wild swings.

I feel like this is a lot like running a casino. A single blackjack table is risky - a lucky player could cost you a lot. But with 500 tables, randomness evens out, and the casino’s returns become predictable. Diversifying your portfolio works the same way. It takes what might look risky in isolation and turns it into a much more stable system.

This chart shows how each asset class is correlated with another asset class. High correlation mean they tend to zig together; low correlation means they don’t necessarily have to. For example, it’s clear that ‘Gold and other precious metals’ have low correlation with ‘U.S. large company stocks’.

Image Credits: Schwab Intelligent Portfolios™ Asset Allocation White Paper

Risk vs Return: A Real Comparison

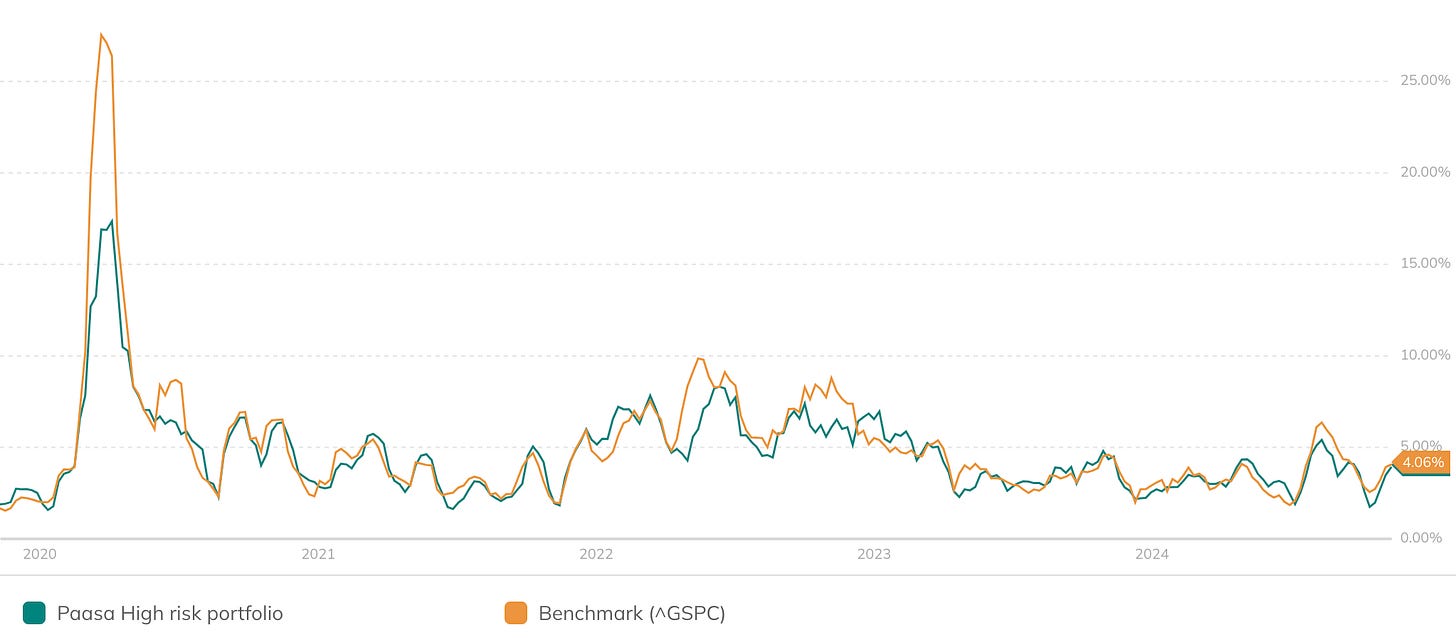

Let’s consider the S&P 500 (^GSPC), a benchmark for U.S. equities.

Turns out, by building a portfolio that includes U.S. stocks, international equities, and bonds, you can beat S&P’s returns while taking less risk. We did this with our Paasa High risk portfolio, a globally-diversified collection of assets. See the comparison below.

Returns - The chart below shows the total returns over the last 5 years -

Charted on Nov 16, 2024.

Risk - The chart below shows the rolling one-month volatility over the last 5 years -

Charted on Nov 16, 2024.

That ~5.5% delta in returns over 5 years might not seem like much, but over decades, it compounds into a transformative financial advantage. All this while dealing with a noticeably lesser degree of fluctuations than the S&P.

You can learn more about this portfolio on the Paasa app.

The Takeaway

Risk is one of the most misunderstood concepts in finance and in life. It’s not something to avoid. It’s something to understand and manage. The people who succeed aren’t the ones who fear risk or take it blindly. They’re the ones who approach it with strategy and a clear vision.

So, the next time your financial advisor talks about risk, ask yourself: is this the kind of risk that creates opportunity, or is it the kind that leads to failure?