Indexing The Index

Why index investing might be the closest thing to a safe bet for your savings

If you’re new to investing you might have across the term ‘index funds.’ Put simply, an index fund is any fund that tracks popular indexes, such as the S&P 500 in the US or the Nifty 50 in India. The composition of these funds is most commonly the companies that constitute the index themselves, based on their market capitalization. For example, the Vanguard S&P 500 ETF's biggest components are Apple (7.12%), Nvidia (6.77%), and Microsoft (6.26%) at the time of writing.

When it comes to index investing, you might also notice terms like ETFs and mutual funds. In short, ETFs are exchange-traded funds that can be bought and sold in real-time with the markets and ‘passively’ follow the index. Mutual funds, in comparison, are actively managed by fund managers and can only be bought and sold at the end of each day based on their value. Each fund has its own pros and cons, with ETFs promising lower fees and mutual funds promising higher returns.

Today, let’s talk about index funds and why you should consider them.

Compounding gains

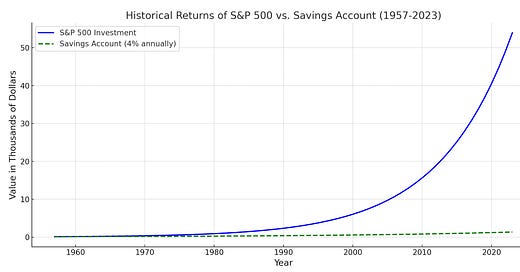

If you’re investing abroad for the first time it’s hard to look past names such as Nvidia or Tesla, which have given shareholders outsized returns over the last few years. Last year, Nvidia's stock surged by 239% and Tesla's by 102%. The S&P, meanwhile, returned a more modest 24% in the same period. However, what makes the S&P, or most index funds for that matter, more promising is the stability of returns. While Tesla stock may go up or down based on the word of the CEO, with the stock seeing some worrying drops several times over the years, the S&P has provided an impressive 10.26% return on average since its founding in 1957.

While each individual year’s performance might vary, history has shown the S&P to be a safe haven for investors, allowing money to compound at over 10% without significant risk. The same reasons that apply to diversification of wealth can be transferred over to stocks: don’t keep your eggs in one basket. But with index funds changing composition based on the size of companies, your benefit rises as one outperforms the other, ensuring you don’t miss out on all the action of a single stock.

A classic example to illustrate the power of compounding is if you invested $100 in an S&P 500 index fund ten years ago. Today, that amount would have risen to $290, or $345 if you reinvest the dividends. But investing is never a one-off task; dollar-cost averaging calls for smaller investments at regular intervals to prevent sudden shocks to your portfolio.

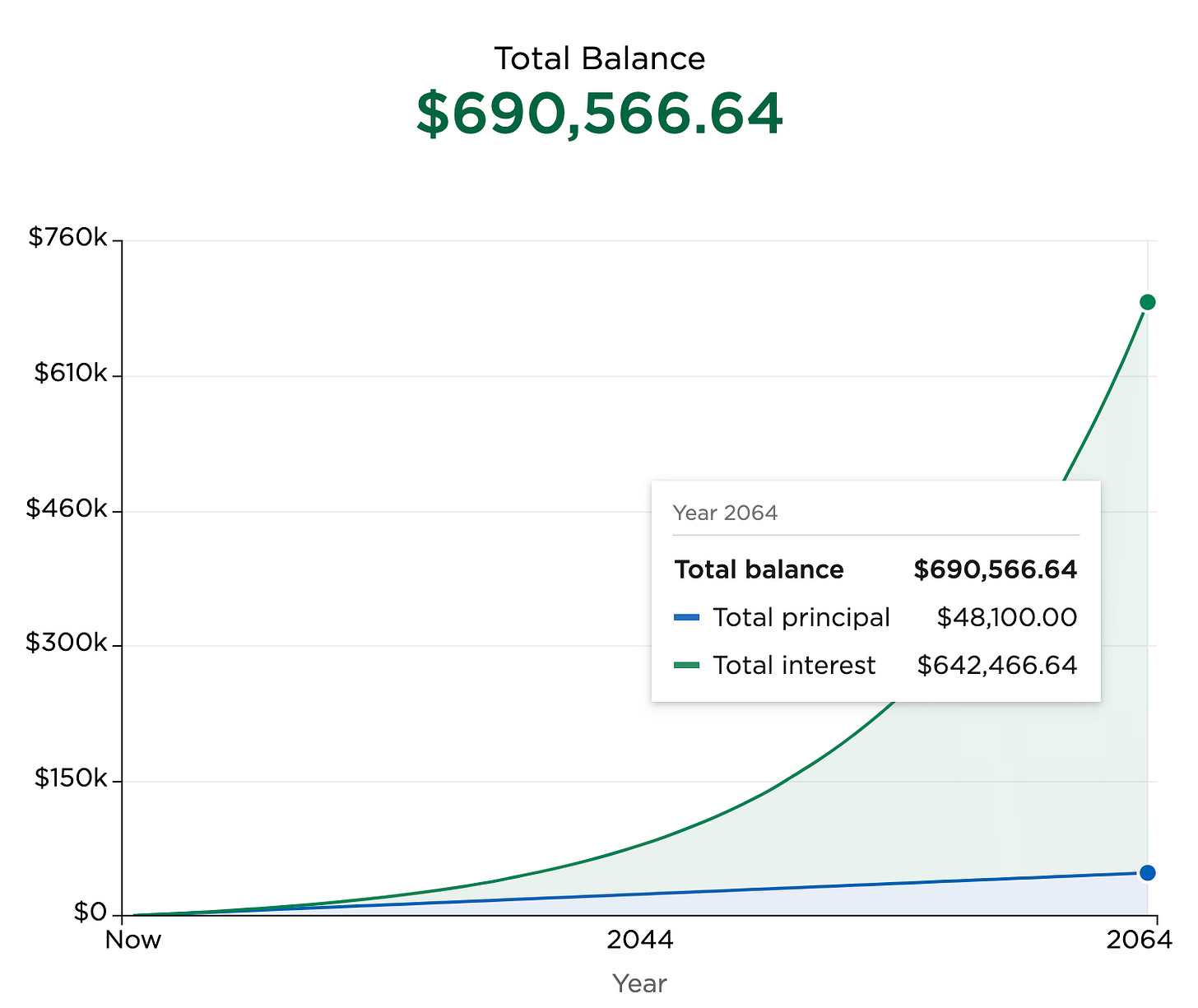

Regular investing is where the compound interest truly shines. If you start with $100 and put in the same amount every year for 20 years, you’ve invested $24,100 in that period. Assuming the same 10.26% average S&P 500 return from earlier, you will now be sitting on $79,319 and change. Continue this practice for 30 years and that figure rises to $241,121 and if you start at 25 and withdraw your money upon retirement at 65, you’ll have an impressive $690,566, all with $100 every month. It’s no wonder that Albert Einstein called compound interest the “eighth wonder of the world.” Here’s that number visualized.

Learn more

If you still are wary of risking a good chunk of your savings in a single index, there are more options out there. Investors with more risk might opt for the NASQAD 100, which excludes financial stocks in favor of other fast-growing categories, or a basket of stocks that are specific to an industry. Each come with their own risks, a topic we covered in detail a few weeks ago.

At Paasa, you can choose between low-, medium-, and high-risk portfolios depending on your personal goals. If you want to look at how we pick our ETFs, read here. At the end of the day, every opportunity comes with risk, but as far as investing goes, index funds might be the closest thing you find to a ‘safe bet.’