The US Dollar / The Indian Rupee

Exploring the lagging and leading indicators that impact the exchange rate.

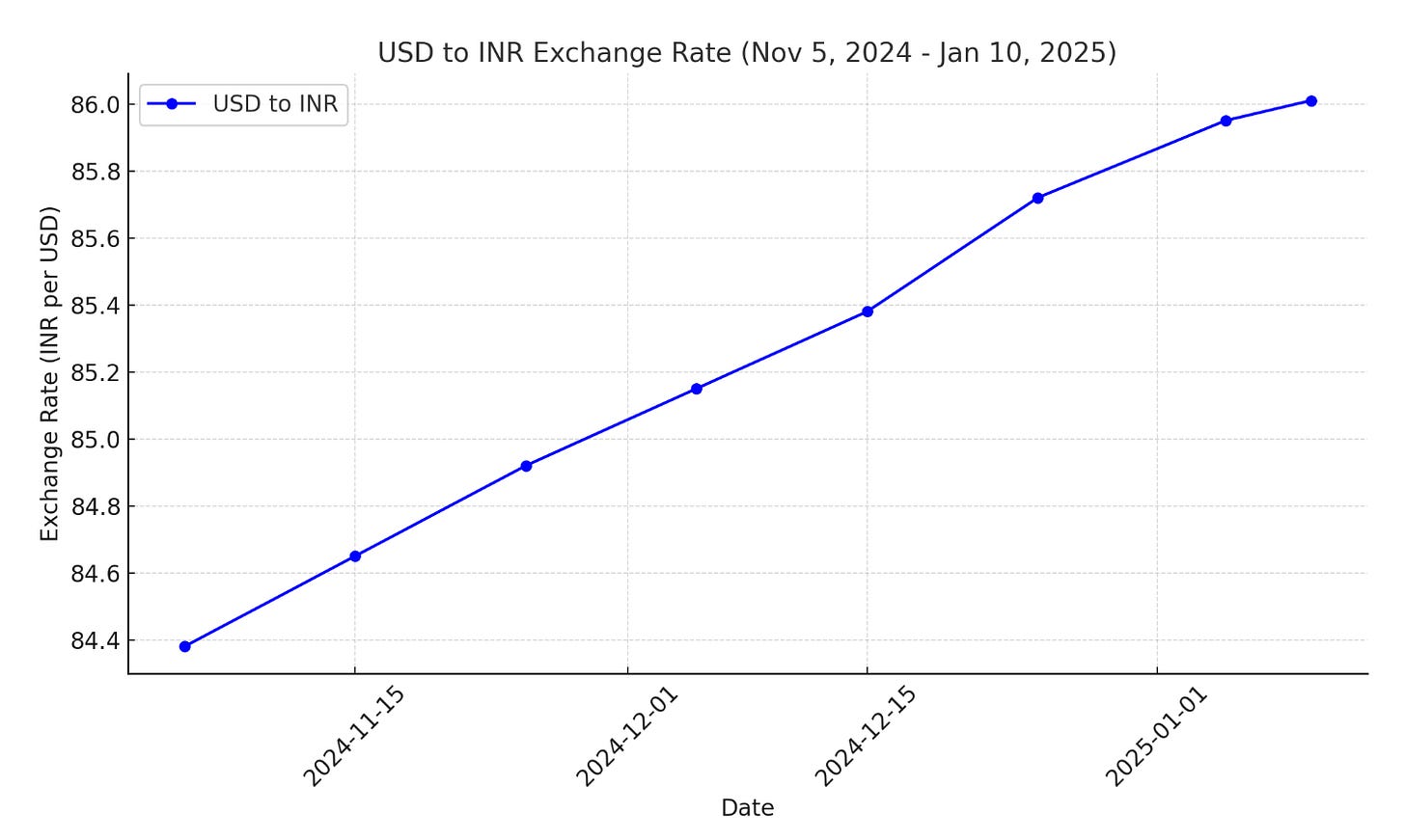

It’s not every day that the US dollar reaches historical highs (by one measure), but this week marked a significant strengthening for the currency. The dollar hit ₹86.20 at its highs, with the INR struggling with domestic equity outlooks and expensive crude oil. However, the real gains for the dollar stem from several positive outlooks in the US. Today, we’ll look through why the dollar is rising on the hopes of a Trump presidency and how the December jobs report has jolted the markets.

When looking at the USD vs INR graph, it’s important to recognize what’s actually occurring beneath the headline rate. The drop in INR value is being caused by either an increase in the supply of rupees, due to capital outflow of trading INR for foreign currencies or using INR to purchase foreign imports, or the decrease in the demand of rupees, due to falling foreign investments on the back of slowing growth and market volatility.

So what’s causing these phenomena today?

The Trump effect

Since November 5th - around the time Paasa launched and the day Trump won office - the dollar has risen by 2.47% from ₹84. A strengthening dollar is bad news for India and residents who are looking to spend on education, travel, or investments in the near future. However, many are pointing to a further slide in the coming months, led by the incoming administration’s economic policies.

Bank of America analysts expect the dollar to hold its strong position through the first half of 2025. Trump has promised three key economic policies, centering around:

trade tariffs

cutting taxes across the board

and deregulation of industry

All three will likely fuel US corporations in different ways, increasing revenues and profits, at least in the short-run.

Tariffs have been Trump’s longest-standing economy belief, ranging back decades. Most believe that COVID derailed plans in 2020 for Trump to expand tariffs to cover more countries, however, 2025 seems to bring new wings to the plan. Reports in the last week have indicated that Trump might look to universally tariff only goods from certain vital sectors, such as defense supply chains (steel, iron, etc.) or energy supplies (batteries, rare minerals etc.). However, President Trump decried the plan on his social media platform, insisting on a universal 10-20% tariff on all goods.

However, it’s hard to ignore that all of Trump’s actions carry a significant risk of inflation as well. Considering the US has only recently emerged from a bout of high prices, with consumers still feeling the pinch on a daily basis. Moreover, the Fed’s decision to ease rate cuts in 2025 to just two reductions signals growing persistence in high prices, which could trend the wrong way if growth isn’t balanced. Universal tariffs, for instance, would lead to immediate price rises for consumers on essentials like food and electronics.

While the dollar remains strong, 2025 will test its resilience as the US looks to upend its historical trade practices.

Things are going well in the labor market

In a New Year’s present to those holding dollars, the US added 256,000 jobs in December per the Labor Department, analyst expectations of around 160,000 on average. Unemployment fell to just 4.1% as median duration of unemployment and permanent job losses dropped as well.

The strong labor market will fuel the Fed’s plan to hold rates steadier for longer, allowing it to combat the final bits of inflation holding back customers. Markets responded with drops across the board, with the S&P 500 falling 1.54% on the news of likely fewer rate cuts. (Covered this in detail in an earlier article)

The resilience of the job market, despite expectations of a slowdown in the coming months, is another reason for investors holding US assets with high rates. With the dollar continuing to appreciate the Indian rupee, we turn to see what’s happening with other global currencies.

Headwinds in rivals

It’s not only the rupee that has taken a beating against the dollar in recent days. The euro, pound, and yen all fell as they each contend with domestic troubles. For India, market volatility has been in focus. GDP numbers in recent months have indicated moderating growth, a worrying sign in an economy still struggling with persistent inflation.

On a closing note, all signs point to the rupee struggling against the dollar in the coming months. While this year’s budget could bring relief to salaries employees in a bid to boost consumption, inflation remains a troubling factor.

Diversifying into dollar-denominated assets remains a wise decision generally, allowing for both safety and steady gains, without the feeling of being squeezed by the USD / INR exchange rate.