Our customers use Paasa for different reasons. Some want to invest in growth sectors like AI, quantum computing, and data centers, betting on the future of innovation. Some want to diversify systematically for the right financial reasons.

But most of our customers use Paasa to save for their children’s education in the U.S.

Why education drives investments

The cost of education is rising at an alarming rate. In the U.S., the average cost of tuition and fees at private colleges has increased by over 134% in the last 20 years. Today, a four-year degree at a top university can cost upwards of $300,000, and that number continues to rise.

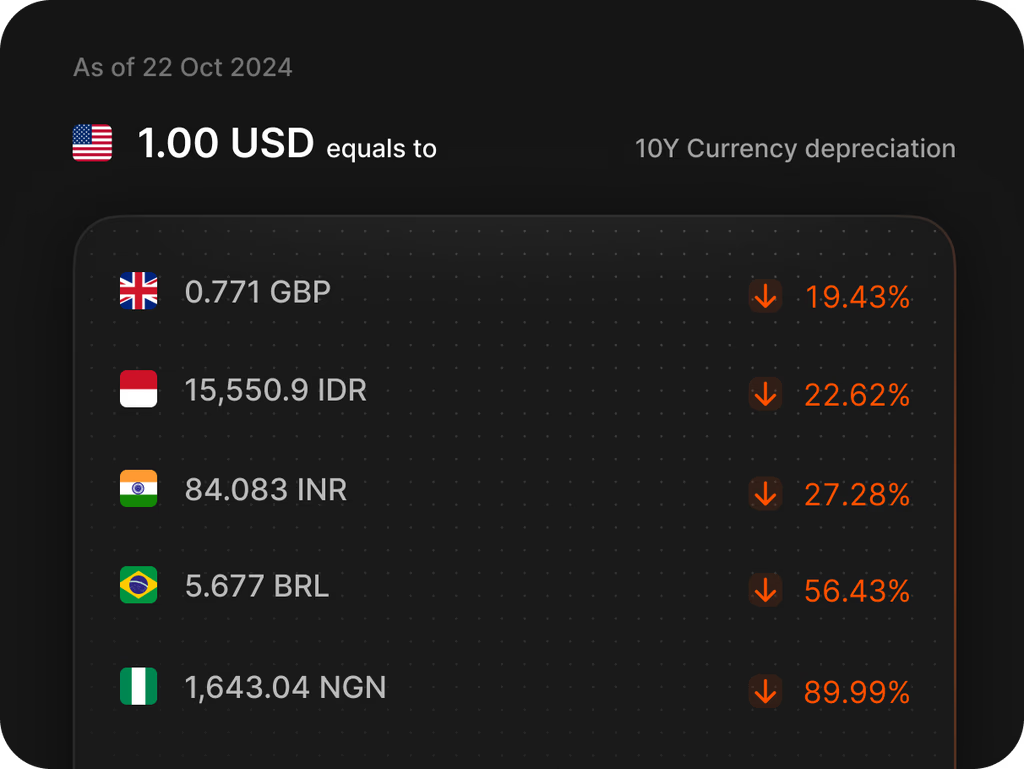

For families earning in a depreciating currency, the challenge is even more significant. Over the past decade, many emerging market currencies have lost value against the U.S. dollar, making tuition costs increasingly unaffordable.

What may have been a manageable amount a few years ago can quickly double or triple in local currency terms, forcing families to contribute more just to keep up.

The risk of not planning early

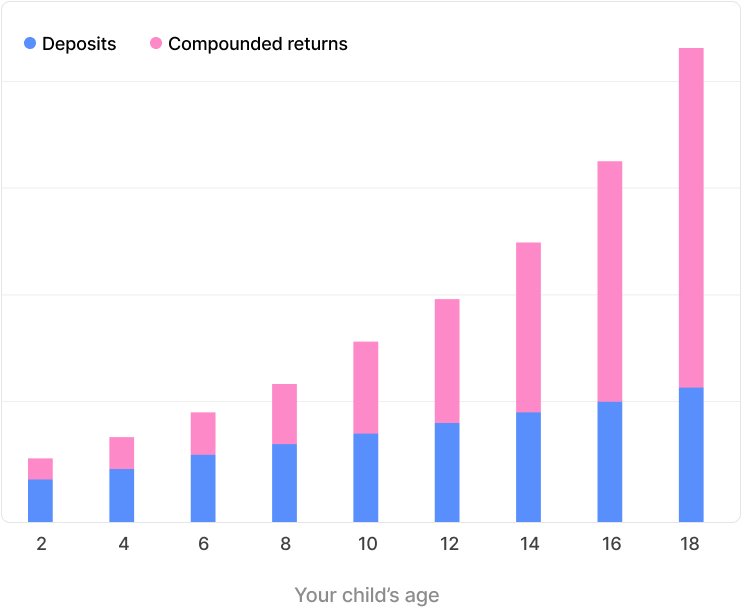

Failing to plan early has consequences. A parent who starts saving when their child is 5 will need to put away around $500 per month to cover tuition at a private U.S. university. If they wait until their child is 15, that number jumps to over $2,500 per month. Without proper planning, families may have to take on significant debt or limit their child's educational opportunities.

The effects of currency depreciation further exacerbate the problem. If a local currency loses value against the U.S. dollar by 5-10% per year, tuition costs in domestic terms will rise even faster than inflation. This means parents who delay saving may need to contribute significantly more just to maintain the same purchasing power for future tuition payments.

The takeaway here is clear: save in dollars, not in your local currency. How?

Glide Path Investing

Glide path investing is a structured approach to managing risk over time. It adjusts asset allocation as the investment timeline progresses. Parents saving for education typically start with higher-risk, high-growth investments and shift toward more stable assets as the enrollment date approaches.

This is the exact strategy used by parents in the US to save for their child’s education as well. The plan is carried out by ‘a 529 savings plan’, a federally approved scheme that parents enroll in.

Key aspects of this plan include:

Early Growth Focus: A higher allocation to equities in the initial years allows for capital appreciation.

Gradual Risk Reduction: As the investment horizon shortens, the portfolio transitions to lower-risk assets, such as bonds and cash equivalents, to protect against market volatility.

Automated Adjustments: A structured glide path ensures that risk exposure decreases systematically, reducing the likelihood of large losses close to the withdrawal period.

How Paasa helps parents save for education

Paasa brings the strategic benefits of the 529 savings to everyone.

Once you’ve opened your Paasa account, we algorithmically carry out glide path investing depending on the time-horizon, monthly investment, and risk you’re willing to take. Then, Paasa will automatically adjust your allocations to align with your plan (with your consent), reducing risk and ensuring you're well-positioned to achieve your savings goals.

Closing note

Education costs are accelerating. If tuition inflation continues at its current pace, today’s newborns will face an even higher financial barrier to higher education.

Subscribe to our blog! And as with most things investing, the key here is simple: start early.