Palantir: What's happening with 2024's best performing stock?

The Denver-based defense contractor has seen wild swings in its stock price,

While Nvidia was the tech stock in the spotlight last year, the best performer was instead a Silicon Valley-born defence startup. Palantir’s stock rose over 340% from under $15 to nearly $80 at the end of the year. And then came the bump.

The company beat its earning predictions from the quarter ending December by 23%, proving analysts wrong. Revenue was up 36% year-on-year and the stock rallied from $83 to over $124 at its peak, rising almost 50%. However, 2025 has not been kind to the market, and Palantir has definitely struggled in recent days. Let’s take a look.

What does Palantir do?

A running joke has been that despite the excitement around the ‘mysterious’ tech company, no one is quite sure what they actually make. Put simply, Palantir is a big data analytics company that creates software products for clients, primarily defence organizations like the US military agencies and Western allies, as well as select private companies that require analytics software.

Palantir was founded by Peter Thiel, Jon Londsdale, Stephen Cohen, and Alex Karp in 2003 as a response to 9/11 and funded in part by the CIA. Karp has served as CEO and has become an outspoken leader, commenting on defence policy, politics, and his dislike of financial analysts that are trying to "scr*w Palantir”.

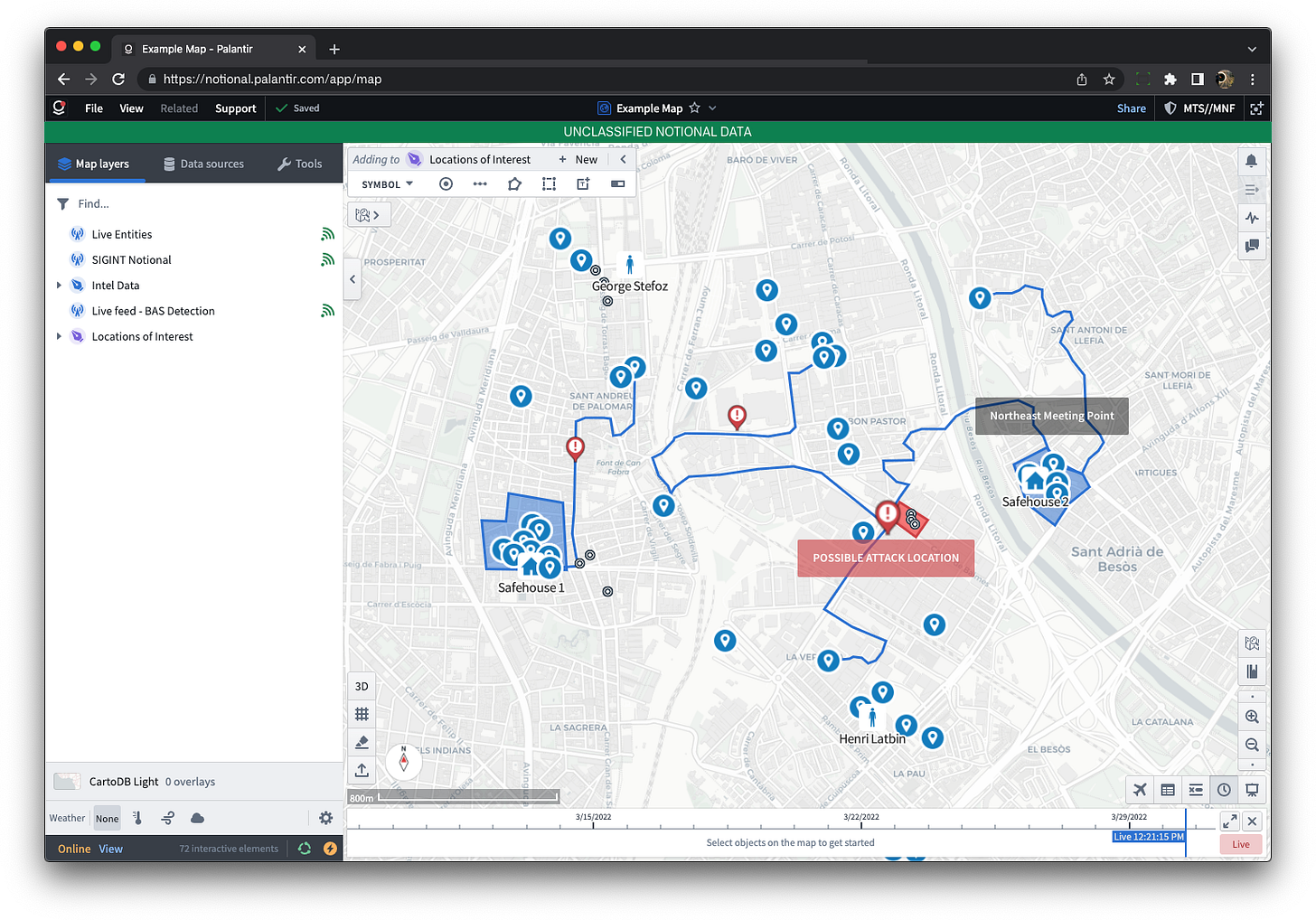

Palantir’s first product was Gotham, launched in 2008. Designed primarily for intelligence and defense applications, the software enabled clients to integrate and analyze large datasets from various sources to identify patterns and potential threats. It’s widely known for being used by the US Army in Afghanistan and Iraq to collate intelligence and detect roadside bombs in conflict zones.

What is driving up Palantir?

The company has since expanded into analytics tools for private customers like Morgan Stanley, National Health Service England, Airbus, and more. The company’s early investment in AI has also paid off in recent years, providing a time advantage in creating and deploying tools, and boosting its market valuation.

Most had never heard of the company until its 2020 IPO, when it emerged from the ‘shadows’ to raise capital. Back then, the company was valued at $22bn with revenues of $742 million the year before. Palantir had never turned a profit before its IPO, with $580mn in losses in 2019 as it invested in product and research.

However, Palantir got the software company treatment, with shares up triple within weeks. The rest is history, as the company has quadrupadable revenue and booked profits, maintaining a rosy picture for the future. Moreover, consistent lower predictions from analysts have seen it beat expectations for four quarters in a row, thirce by double digits, all bringing the stock to its record highs in 2025.

What’s next for the company?

Palantir’s stock suffered a combination of a larger market cool-off and Trump’s plans to scale back spending at the Department of Defense. As a defense contractor, the company is exposed to any cuts to the sprawling US defense budgets. While the company is building up in Europe as well, primarily the UK and France, business there is growing at a modest 4%, while the US at over 20% in recent years. The news caused the stock to tumble from an all-time high of $124 in late February to $85 in April.

Despite revenue standing at $2.87bn, investors expect the company’s punchy profile, lower overhead costs compared to its peers, and focus on advanced technologies will propel it to the front of the emerging $150bn+ AI software market (per Nasdaq) in the next three years. Critics argue that the stock is overvalued given the current defense spending climate and a competitive market.

Early investors have already made huge gains from supporting the stock in early 2024 or even since the IPO in 2020. However, Palantir’s push into Artificial Intelligence Platform has created massive opportunities with companies across industries, evidenced by a strong revenue pipeline from existing contracts.

As always, tech companies carry a much higher premium on price-to-earnings ratios due to their future potential. Palantir’s history shows that it has a strong runway to future revenue, especially as defense takes focus globally. However, stock market uncertainty and spending cuts leave the stock vulnerable to sharp rises and falls, a risk to note.

This article is for informational and educational purposes only, and not intended as financial advice.