Bonds hit record investment in 2024: Should you be looking to invest?

Bonds reached a record $600 billion securement this year, buoyed by interest rates and uncertainty

In the past few weeks we’ve focused keenly on equity markets, be that through ETFs, stock selections, or recent news. However, the other side of the coin is the bond market, which has seen rapid growth this year. In 2024, investors poured a record $600 billion into bonds of all classes, betting that a reduction in interest rates will bond fuel returns.

Before we jump in further, let’s quickly discuss what bonds are. Bonds are a loan made to a corporation or government by an investor in exchange for a fixed return rate. This means investors receive a fixed interest income on these bonds as well as the promise of the principal back after a period. You may have heard of the US Treasury Note (T-Note) lasting one to 10 years, the T-Bond lasting 20 to 30 years, and the T-Bills lasting four to 52 weeks. The yield on a bond is the annual interest an investor earns each year until maturity.

Notably:

What happened in 2024?

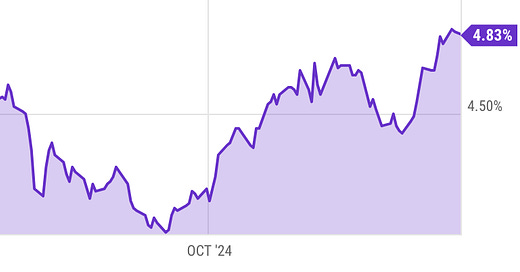

2024 marked a change in the stance of most central banks toward lowering interest rates as inflation eased. The lower interest rates, in turn, will likely see higher yields and prices on bonds, boosting investments in this asset class. The movement of the bond market is clearly linked to rates, as seen in this graph.

Bonds are seen as the ‘safer’ choice to equities, explaining why fears of a recession in the US led to a sudden spike in yields and in turn, lower prices. However, as such fears eased and the Fed indicated slower cuts next year (which we covered recently), there was a selloff in the week before Christmas worth nearly $6 billion.

A look at corporate bonds

As we noted earlier, bonds are issued by companies as well. Corporate bonds had a particularly strong 2024, with investors heavily buying fixed-income assets. The move toward bonds was fueled by two major factors. The first was a bullish stock market pushing risk-averse investor toward safer corporate bonds, hedging their bets. The second has been a lower credit spread between government and corporate bonds since the US Presidential elections, allowing companies to issue bonds cheaply to keen investors.

The week after the election alone saw a massive $50bn raised by corporations in the US, with big names like Goldman Sachs and Caterpillar taking advantage. The lower credit spread means that companies can pay small interest premiums over the US Treasury bonds to secure investment.

As we enter 2025, keep an eye out on the bond market as investors eye whether the economy will continue to grow under the new administration or whether policy changes lead to losses. This will dictate whether bond markets will continue their record runs.